The TV Set Market

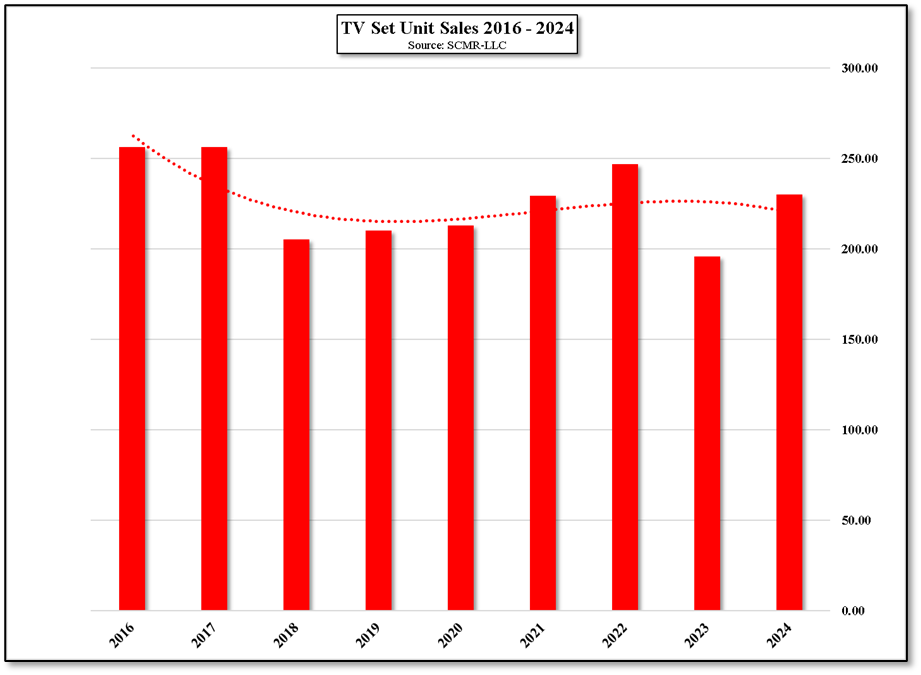

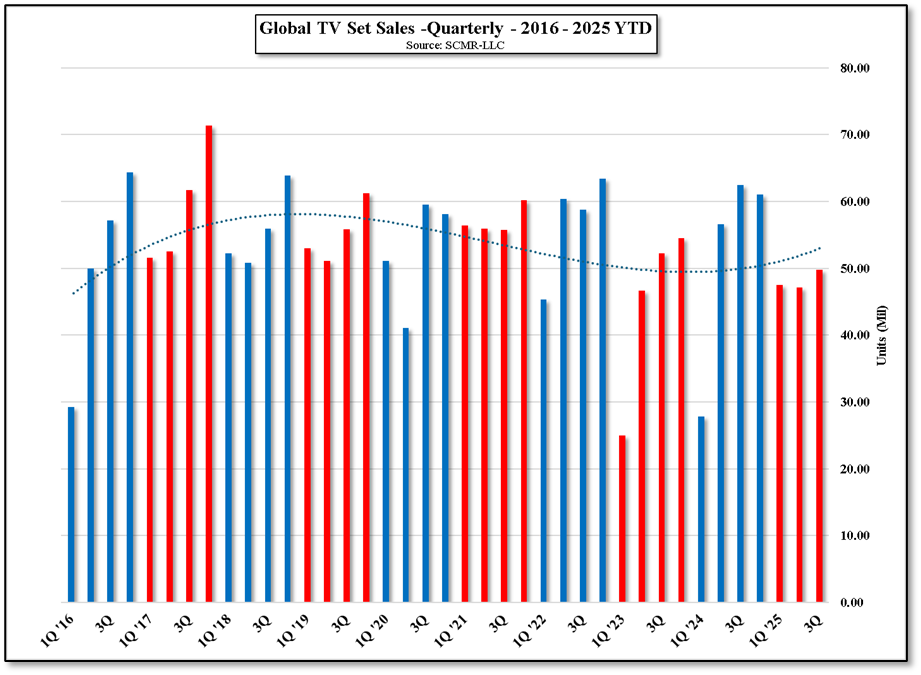

TV set sales in 3Q of this year are expected to fall below 50 million units for the first time in over 10 years and is almost 8 million units below the 5-year 3Q average. 4th quarter TV set shipment estimates are for 53.2 million units, also below the 5 year average (59.45 million), although we believe that promotions in China might make the final 4Q unit volume a bit higher than forecast. In order to meet the aggregate forecast for 2025 (202.35 million units) 4Q would have to come in at 58 million units, which seems it might be a stretch, leaving 2025 as another disappointing year for TV set sales.

Market Deceleration & Loss of COVID Gains

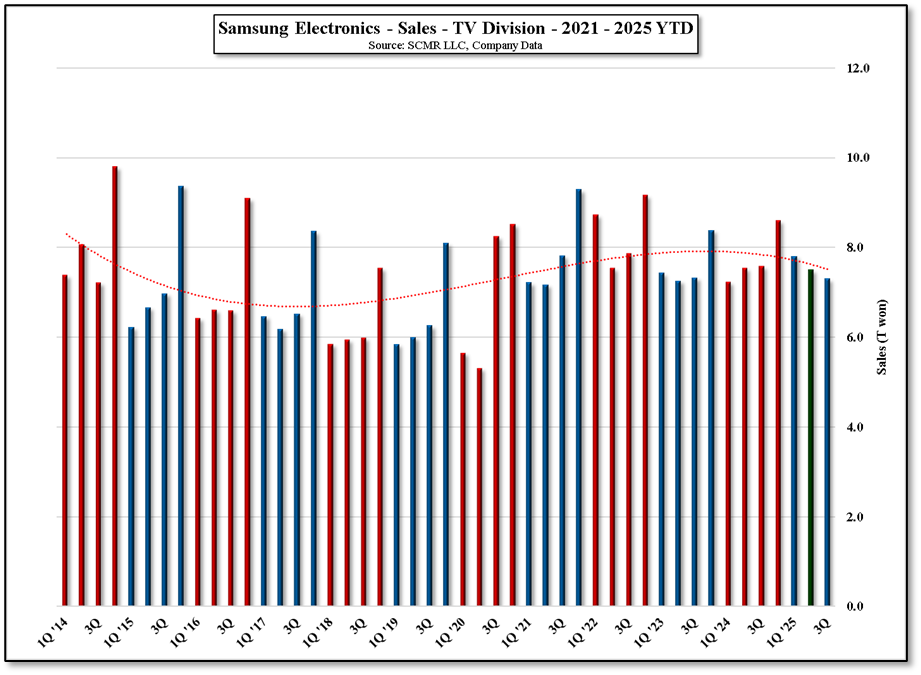

The TV set industry is experiencing a period of deceleration, illustrated by almost zero near-term growth and few long-term forecasts that can justify a CAGR above 1%. Recent results from Samsung Electronics (005930.KS) Visual Display division (TV sets), the leader in the TV set space, faces the same problem as the positive effects of the COVID pandemic fade and TV set sales drift downward, becoming increasingly dependent on a strong 4th quarter and premium TV products to keep from showing negative unit sales growth. In order for the industry to regenerate itself, it needs to not only restructure its supply chain but also find a path out of the commoditized ‘Bigger is Better’ market and rely more on consumer recognizable technological differentiation.

Quick Note – Lack of Data

Before we go further, we note also that in years past there were a number of firms that published TV set shipment forecasts and volume on a quarterly basis, however over the last two years a number of those firms have been acquired and absorbed, leaving only a small number of firms that follow the TV set space and few forecasts. A number of those remaining no longer publish TV set units, focusing entirely on share. As we do with other CE products, we aggregate as many forecasts and reports as possible to arrive for an average that reduces the effect of outliersw, but we note that with the dwindling number of quarterly and yearly forecasts, we see the numbers for TV set unit volume as ‘less rich’.

Limitations to TV Set Growth

So what is making it so difficult for consumer electronics brands to sell TV sets? We see a number of factors limiting TV set growth .

- Borrowing – During the COVID pandemic consumers, forced to remain sequestered, upgraded their TV sets as a crucial form of entertainment. While this process of ‘borrowing’ future sales to satisfy near-term singular demand has less appeal to consumers, brands seem to have latched on to the idea. Most recently brands pulled in 2H orders in anticipation of tariffs and trade issues, which depressed late 3Q results and could lighten demand in 4Q.

- Replacement Cycles – While the average lifespan of LCD TVs has not appreciably changed over the last decade (5 – 7 years), the type of failure has changed. Component failure was the issue years ago, while the issue today is obsolescence. LCD displays can last for 10 years or more but as they age they lose brightness, so while specs tell you the approximate length of time before a display is at half brightness, many consumers will find the set to be unacceptable sooner. That said, within limits, brands have maintained this 5 – 7 year lifespan even with brighter displays (usually degrade more quickly), keeping consumers from upgrading. The typical point of replacement is less a component failure and more a distaste for the quality of the picture, moving the decision from an absolute one to a qualitative one.

- Inflation – Consumer buying power erodes as inflation rises, but underlying the obvious is the psychological effects of inflation. When you are concerned about how you are going to pay your mortgage, you are less likely to upgrade your TV, allowing the qualitative decision to be a bit more tolerant of a lesser picture quality.

- Technology – TV technology is mature. Yes, designers and engineers spend an entire year coming up with something new to set them apart from other brands, but the impact of those changes on consumers tends to far less than the brand’s focus. With over 50 global TV set brands differentiation is a very big internal topic among brands but many seem to believe that the average TV set buyer is just as interested in the fact that the new model from XYZ TV Co. can show over 1 billion colors while ABC’s set can only show 16.7 million. Most consumers are primarily interested in price vs. quality, while most TV set evaluations are more interested in the deeper technical aspects of TV sets. Budgets do make a difference and while consumers do buy TV sets on-line (30% - 35% globally) the majority buy sets after viewing them in a brick-and-mortar location. Seeing how a set looks is a big motivator for upselling while the idea that a set can generate 10 times the number of colors that the human eye can see is less of a driver.

- Competition – There are two kinds of competition in the TV set space.

The other point of competition is platform based. TV sets compete with smartphones, tablets, and laptops for consumer viewing time and if consumers spend far more time watching videos on their phones than they do on a TV set screen, they will allocate more disposable income toward their phones and less on their TVs. Brands have tried a number of times over the years to make TV sets the household ‘hub’ but TV sets are not mobile, and consumers are not always positioned near a TV. Smartphones are good competitors.

Relying on Area Growth

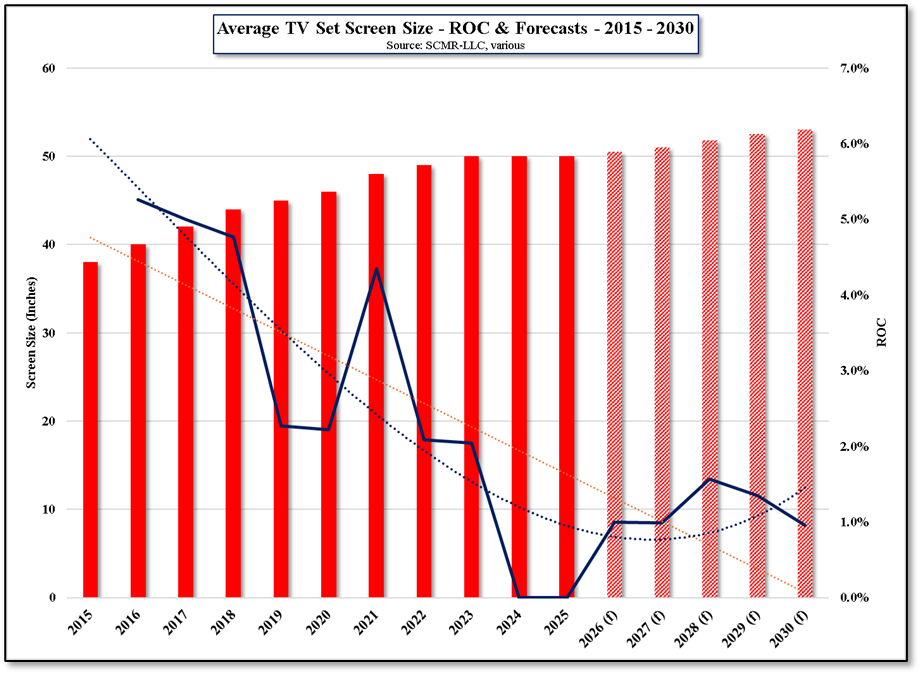

There are two basic functions that drive panel production, utilization, essentially keeping the fab producing at as close to 100% of possible production time, and using the fab to produce high margin product. Over time the production process for each panel size becomes mature and competition puts pressure on panel prices and margins. Larger panel sizes are more difficult to produce and therefore carry a premium over smaller sizes, especially if they are able to be efficiently produced on the fab’s substrate size. This encourages panel producers to produce larger panels, even though very small panels are more profitable on a per in2 basis than medium sized panels. Panel producers will offer ultra-large panels to brands to boost margins and create differentiation, and as ultra-large TVs also carry a premium at the brand level, they are an attractive way to offset smaller panel margin compression at the brand level. Over the last 10 years, the average panel size has grown ~32% as brands made ultra large size sets available at lower prices, but there is a finite limit to how large TV sets can grow, and even the most optimistic forecasts for average TV set size see a much slow ROC going forward (6% growth in average panel size between 2025 and 2030).

With retail TV sets at or near 100” physical constraints become an issue and size growth slows. As panel producers and brands have been relying on screen size growth for TV set area and sales value growth, we expect that such growth will be more moderate going forward and size expansion will be limited. We do expect the average size of TV sets overall to still grow as prices for ultra-large sets decline, but the increases will be moderated by physical limitations. Not everyone can fit a 100” TV in their apartment..

The convergence of several factors—the pull-forward of sales during the pandemic, the long and feature-complete replacement cycle of modern displays, and persistent macroeconomic pressure—has driven the TV set market into a period of deceleration. With 2025 3Q unit volumes projected to fall back to 2015 levels, the sub-1% long-term CAGR confirms that the historic, volume-driven model is structurally broken. The "Bigger is Better" paradigm has met its physical and economic limits, while incremental technical differentiation is failing to motivate the average consumer.

Industry leaders, as evidenced by the performance of the segment’s leader, are now heavily reliant on premium segments and volatile holiday quarters to maintain positive unit growth. The current landscape is further defined by intense price competition from subsidized Chinese brands and a fundamental competition for consumer attention from mobile platforms.

Meeting the demands of the future requires more than supply chain restructuring. It demands a new value proposition that transcends price wars and commoditized screen sizes. The industry is at a critical inflection point, requiring a shift from being hardware sellers to being experience oriented. The discussion must now turn to the specific strategies and innovations needed to unlock value and regenerate consumer demand, which we will cover in our next note on the TV market.

RSS Feed

RSS Feed